Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

Examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, here, and here.

----------------------------------------------------------------------------------------------------------------------------------------------------

Do you have a competitive advantage to help you beat the market indexes?

If not, you stand no chance of beating the indexes in the long run.

Without a sustainable competitive advantage, most investors will be much better off investing in index funds.

Furthermore, investors lacking a competitive advantage stand no chance to beat Wall Street.

For example, consider the following facts about Wall Street professionals and fund managers.

Finally, most of the biggest investors and investment firms have access to insider information.

How can you compete with investors who have insider information?

You stand no chance without a competitive advantage.

WHAT'S YOUR COMPETITIVE ADVANTAGE?

Are you getting a competitive advantage by watching CNBC, Bloomberg, or Fox Business?

Maybe you think you're getting a competitive advantage by reading Barron's or the Wall Street Journal.

If you actually think you're going to obtain a competitive advantage or even some kind of edge by following the financial media, I have ocean front property in Wyoming that I'd like to sell you.

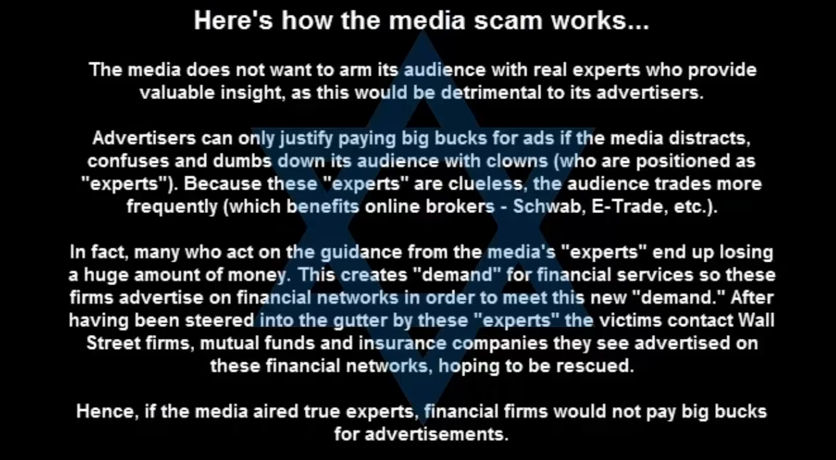

Most investors are oblivious to the fact that all financial media is useless.

In fact, the financial media is detrimental to your investment performance.

That's the way the financial media has been designed.

Mike Stathis has been exposing the media scam for well over a decade.

And he's published hundreds of articles and videos showing how it operates.

And then there are those really naive investors who think they'll find value by reading the lowest level financial content plastered on hundreds of websites, such as Yahoo Finance, MarketWatch, Motley Fool, The Street, Morningstar, Benzinga, Seeking Alpha, Zach's, Tipranks, Insider Monkey, Guru Focus, etc.

Let's get real. These websites are boiler rooms that publish complete trash.

They all publish ad-based content which has been proven to be disinformation.

They also sell paid subscription services using false claims in order to lure the sheep into their trash.

But the fact is they have no investment experts publishing their content.

Instead of experts, they employ copywriters, cons, and scam artists.

It's quantity over quality. That's the business model of ad-based content.

The content from these types of websites is pumped out like a machine for the purpose of triggering search engine results intended to lure more sheep into the slaughterhouse of scams and deceit.

Similar to financial TV networks and newspapers, these copywriting boiler room websites hide behind the shield of being classified as media companies in order to get away with deceiving and defrauding the public with fake news, stock manipulation, and false claims.

And they pay websites like Yahoo Finance and many others to have their content published so that everywhere you look you see their content.

Mike Stathis has previously described this as the media's "flooding approach."

Others actually think they can invest well by listening to fake investment gurus on social media.

The problem is that such individuals aren't even aware they are listening to frauds and idiots.

If you actually think you're going to gain a competitive advantage by listening to fake investment gurus on YouTube, Facebook, and other social media platforms, even God won't be able to help you.

It's important to remind you that ALL of the sources I have mentioned are partners with the copywriting industry because they sell advertisements promoting sensational videos from con artists like Jim Rickards, Porter Stansberry, Whitney Tilson, Nomi Prins, Jim Rogers, Harry Dent, Robert Kiyosaki, David Stockman, and hundreds of other copywriting clowns.

Mike Stathis has previously exposed these and countless other cons, so check the website.

There aren't many sources that can help you gain a competitive advantage because there aren't many real experts who are willing to help main street.

With rare exception, all of the real investment experts are focused on making money for themselves by managing large funds. They aren't going to waste time with media interviews unless they want some face time just to market their fund.

But if their fund is truly doing well, they won't need to market themselves.

So when you see real experts giving interviews in the media, you should conclude one of two things. Either they aren't real experts or else their fund isn't doing so well.

Everyone else promoted by the media as an "expert" has no clue what's going on. Instead of an investment expert, these people are really a marketing experts. But if you aren't sufficiently knowledgeable about the markets, you're likely to be fooled by their fast talking BS lines. These characters pose as experts in order to market themselves so they can land big speaking fees at investment events and conferences, pitch their useless books, and so on. That's how they really make their money, not from investments.

Even on the rare occassion when a legit fund manager or other true expert appears in the media, you won't hear anything from them that will help you perform well in the markets. That's a guarantee from Mike Stathis.

He knows this because he has been observing the financial media for many years, so he knows all of the games and tricks they play.

Yet investors are always searching for this "holy grail."

That explains why they watch financial media shows and read articles on websites.

They think they will be able to spot when there's some value.

The reality is that you won't know when you've come across valuable insight in financial media unless you're a very knowledgeable investor.

Some of you might be thinking that you're a very knowledgeable investor.

If that's the case, why would you waste your time searching for valuable insight in one of the worst places - in the financial media?

If you think the financial media provides a good source of investment insight, you aren't a knowledgeable investor.

You're what's commonly referred to as the "dumb money."

HOW CAN YOU GET A COMPETITIVE ADVANTAGE?

You need access to a top investment expert.

And you need access his excellent research.

You also need to either have or else develop good judgment.

In this case I will define "excellent research" as an unbiased source of unique insight with a proven track record of excellent forecasts and recommendations.

Note that the insight needs to be somewhat unique or else it won't be so valuable.

Part of having a competitive advantage means your insights are unique.

That's how you find yourself on the winning side of the trade or investment.

If the insights are not at least somewhat unique, there is no competitive advantage.

Ideally, you should aim for access to a top expert with extensive industry experience, as well as a long history of consistently proven results as seen by their track record.

Ideally, you should seek out a top expert with a long history of great results, as well as the ability to think independently. This individual will know when to counter investment recommendations of "top experts" and analysts. Such an individual will be capable of providing unique insights.

We know of no better person that fits the description above than Mike Stathis.

Mike is that exception I spoke of earlier. That is to say he is a true expert who isn't focused on making money for himself. Over the years he's declined numerous offers to run investment funds and to lead research departments at several funds.

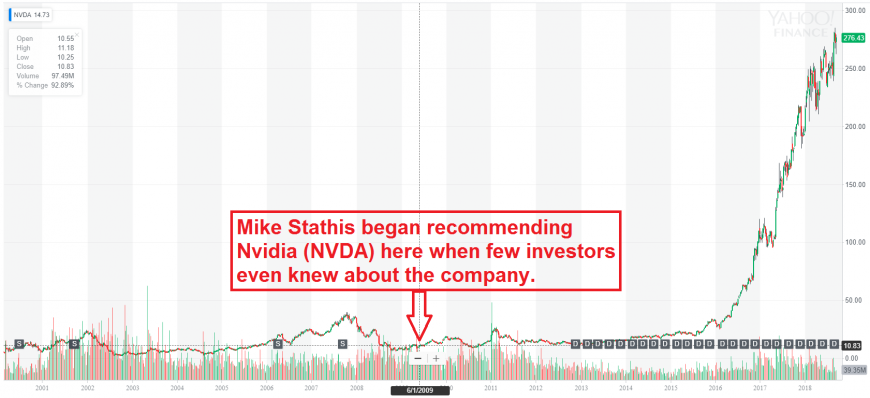

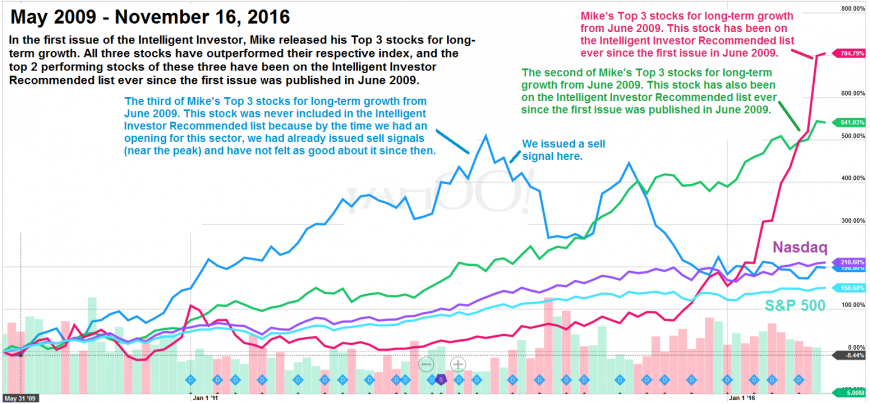

Take a look at a few of his remarkable investment calls in the chart below.

Note: If you are unable or unwilling to go through and examine each of these well-annotated charts and carry out the sufficient leg work required to understand and appreciate the significance of Stathis' insights and recommendations as shown in the charts below, you will never be able to utilize world-class research such as that published by Mike Stathis.

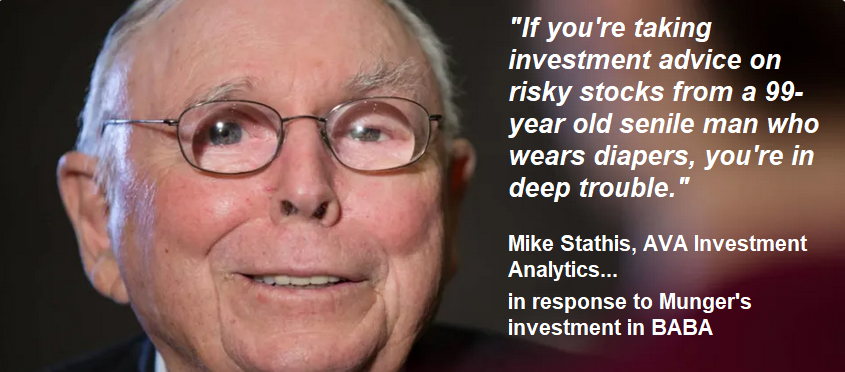

The following charts illustrate how Mike was warning about Alibaba (BABA). He specifically told investors to avoid the stock. Mike had been warning about the dangers and risks of U.S.-listed Chinese stocks years before it was discussed in the media.

Meanwhile, the "legendary investor" Charles Munger was buying Alibaba (BABA) while praising the company and the Chinese government.

See Charlie Munger's BABA Blunder. Mike Stathis Warned About BABA Well in Advance (Part 1)

See Charlie Munger's BABA Blunder. Mike Stathis Warned About BABA Well in Advance (Part 2)

See Bill Miller Bought Alibaba (BABA) as a "Great Value" Stock in 2022

It's time to get the BEST COMPETITIVE ADVANTAGE money can buy.

The amazing thing is that we're offering the world's best investment research at affordable rates.

(until further notice, new research subscribers must first apply for access to our research)

Intelligent Investor Market Forecaster Dividend Gems CCPM Forecaster

Profit While Learning from the World's Best Investment Analyst

(Track Record is Here)

The reader can examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, here, and here.

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #3

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #2

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #1

Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

It is critical to understand and always remember that no legitimate source that provides credible content sells advertisements or provides endorsements. These are the kinds of shady activities that charlatans and influencers are involved with. If you do not fully understand why this is the case, we invite you to examine the more than 500 articles, videos and audios explaining why, providing specific examples.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

We have documented, time stamped publications backing the results in the following charts.

Most of the material shown in the following charts can be found in our track record links (see the links below).

We have documented, time stamped publications backing the results in the following charts.

Most of the material shown in the following charts can be found in our track record links (see the links below).

We have documented, time stamped publications backing the results in the following charts.

Most of the material shown in the following charts can be found in our track record links (see the links below).

.png)

We publish four (4) monthly research publications which provide the highest quality analysis (without any of the BS) found anywhere:

Stathis Shows Ackman, Soros And Bass Who The Boss Is

INTELLIGENT INVESTOR (track record links)

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Excerpts Of The October 2014 Economic And Securities Supplement Audio 2

Who Do You Think Nailed the Latest Market Selloff AGAIN?

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Stathis Nails the Gold & Silver Trade Again

We Predicted The Market Selloff Yet Again

More Proof Wall Street Research Is Useless

ANOTHER Security From Our Recommended List Gets Bought Out

We Predicted The Market Correction AGAIN

Does AVA Investment Analytics Have Insider Information?

We Pin-Pointed the Past Two Market Tops And Bottoms

Does AVA Investment Analytics Have Insider Information?

4-Day Gains of 30% for 2011 and 2010 Performance

Another Huge Winner in a Few Weeks

Newsletter Stock Recommendation Soars More Than 25% in Just 3 Days

Can a Book Serve as a Crystal Ball?

Since The Market Lows, Only One Man Continues To Shine

Mike Stathis' Near-Perfect Market Forecasting Record

Another Security from the Intelligent Investor Soars

How to Short Stocks: Critical Lessons from the Intelligent Investor

Mike's Top 3 Stocks for Long-term Growth

Where Is The Stock Market Headed?

DIVIDEND GEMS (track record links)

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Dividend Gems Subscribers Are Treated To Yet ANOTHER HUGE BUYOUT - Kraft

Dividend Gems Scores Another Huge Winner

Dividend Gems Scores ANOTHER Huge Payday

We Sold CenturyLink BEFORE It Collapsed

Warren Buffett Follows Our Lead On Heinz

Did You Own The BEST PERFORMING Stock In 2011? WE DID

Dividend Gems Destroys The S&P 500 Index AGAIN

Dividend Gems Holds Up As The Stock Market Collapses

Dividend Gems Continues To Smash The S&P 500 Index

Dividend Gems Outperforms Again

Dividend Gems Shines As The Market Corrects

The Impressive Performance Of Dividend Gems

MARKET FORECASTER (partial list; see this link for more)

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Who Do You Think Nailed the Latest Market Selloff AGAIN?

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Market Guidance: Past, Present And Future (pre-newsletter, also see America's Financial Apocalypse)

A Lesson In Market Forecasting

Where Is The Stock Market Headed?

We Pin-Pointed The Past Two Market Tops And Bottoms

We Predicted The Market Correction AGAIN

Mike Stathis' Near-Perfect Market Forecasting Record

Since The Market Lows, Only One Man Continues To Shine

AVAIA Market Forecast And Recommendations SPOT ON, AGAIN

We Predicted The Market Selloff Yet Again

COMMODITIES, CURRENCIES & PRECIOUS METALS FORECASTER (track record links)

WTI & Brent Crude:*

Henry Hub Natural Gas:*

Gold & Silver:*

Mike Stathis Nails The Gold And Silver Trade Again (Oct - Nov 2015)

Guess Who Nailed The Most Recent Gold Trade AGAIN

Mike Stathis Nails The Latest Gold & Silver Trade (Jan-Feb 2015) Updated

Stathis Nails The Gold & Silver Selloff AGAIN - Jul - Sep 2014

March 25, 2013 Gold Analysis & Forecast

The REAL Precious Metals Expert Shows You How it's Done

Stathis Nails the Gold & Silver Trade AGAIN

August 2012 - We Nailed The Gold Breakout

Mike Stathis Sets The Record Straight And Cleanses Your Mind

Other Videos Showing Stathis' Track Record

Proof That Mike Stathis Has The Leading Track Record On The Economic Collapse

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

FACT: Mike Stathis is the leading expert on the economic collapse.

He has enabled his clients to profit BEFORE, DURING and AFTER the collapse.

No One in the world can match his track record from 2006 to current and he has backed that claim with a $100,000 guarantee which was expanded to a $1 million guarantee.

The first thing you might want to do before continuing is to watch the video on this page. CLICK HERE.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

The following list contains only a tiny portion of accurate macroeconomic forecasts and predictions made by Mike Stathis (verified by published research):*

* these forecasts do not include the accuracy of market forecasts and securities guidance provided in the research.

Newsletter Performance Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] [21] [22] [23] [24] [25] [26]

Video Presentation Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10]

The links discussing the results of the video presentations above pertain to two video series published in April 2012 – “20 Stocks Over $100” and “60 Stocks Poised for HUGE Moves”

Note: several additional winners from these presentations that have not been included here for lack of time.

In the past, we also gave away some nice freebies as well:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19]

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.